FINOP is the term you may have encountered if you are in the financial services industry. But what is a FINOP, and why is this position so important to the broker-dealer companies? It is perhaps best understood by saying that it is a FINOP (or Financial and Operations Principal), the person who assumes responsibility for the financial operations of a firm and its regulatory obligations.

This position plays a crucial role in ensuring the financial integrity of broker-dealers and their adherence to FINRA and SEC requirements. There are various implications in the world of brokerages. Whether you are opening a new brokerage or running an established one, it is essential to understand what a is FINOP, so that you can stay compliant and avoid significant fines.

Table of Contents

What is a FINOP and What Does It Stand For?

FINOP is a term and it is an acronym used to denote Financial and Operations Principal. This is not just a title, but a mark of expertise in the financial services industry. A FINOP must hold either the Series 27 or Series 28 certification and is responsible for the financial reporting and net capital compliance of a firm, as well as its regulatory filings. One can only understand what is a FINOP by being aware that this position acts as a financial watchdog within the firm, ensuring legal and sustainable operations.

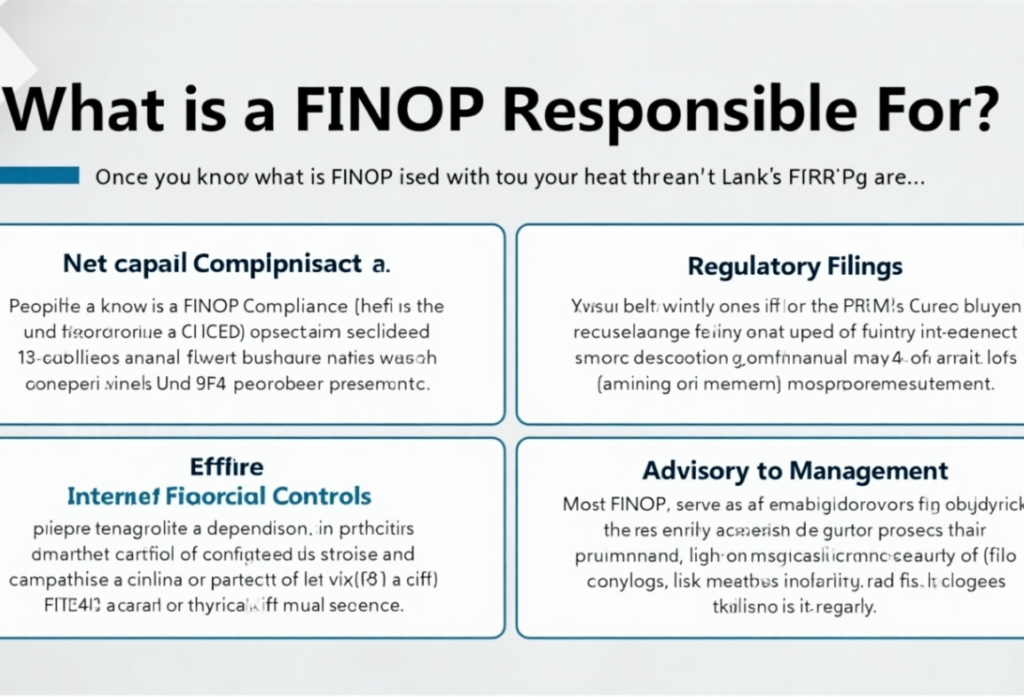

What is a FINOP Responsible For?

Once you know what is a FINOP, then you have to know what the main tasks of a FINOP are. These include:

Net Capital Compliance

Properly functioning FINOPs comply with the Securities and Exchange Commission (SEC) Net Capital Rule (15c3-1), which requires a broker-dealer to possess a specific amount of net capital to conduct business.

Regulatory Filings

They submit major filings, such as annual audits and Form U4 custody, to ensure compliance with FINRA and SEC reporting requirements.

Internal Financial Controls

They establish rules to facilitate accurate recording and protect themselves against fraud or monetary misrepresentation.

Advisory to Management

Most FINOPs serve as financial advisors to leadership, assisting in the decision-making process in areas such as budgeting, risk management, and compliance strategy.

Who Needs a FINOP?

Knowing what is a FINOP, also implies knowing who has to possess one. Every FINRA-regulated broker-dealer firm must have at least a full or outsourced FINOP. This includes:

- Clearing broker-dealers

- Introducing firms

- Prop trading firms, where the customers deposit their money

Even firms that do not take customer accounts must appoint a limited FINOP, provided they are registered with FINRA.

What Makes a FINOP?

To qualify as a FINOP, one has to:

- Be a member firm of the FINRA.

- Get a FINRA sanction.

The tests include financial reporting, regulatory compliance, and accounting principles, among others.

What is an Outsourced FINOP?

To several smaller firms, the inability to employ a full-time FINOP is impractical. That is where the outsourced FINOP services center is located. This will enable the firms to remain in compliance with the overheads of maintaining a salaried staff.

Benefits of an Outsourced FINOP

- Affordable compliance alternative

- Connection to proven hands

- Increasing population of firms scalable with firm growth

- All regulation coverage, without full-time commitment

Once you understand what a FINOP is and the importance of their role, outsourcing is a great choice, even when you do not want to keep them in-house.

Why is a FINOP Important?

A company that does not have a FINOP should face the risk of non-compliance, which could result in fines, suspension, or even the revocation of its licenses.

The FINOP ensures:

- The financial wellness and the solvency

- Efficacious risk management

- Regulatory timely reporting

- Open businesses that safeguard customers

Conclusion

You now know what is a FINOP, and it is evident that this position is essential to the achievement and compliance of any broker-dealer firm. Whether in-house or outsourced, it is the qualified FINOP who will ensure your business runs smoothly, is financially sound, and avoids regulatory problems. When starting a new brokerage or reevaluating your compliance department, ensure that a FINOP plays a significant role in your organization, as otherwise, you are operating within a strictly regulated environment without a clear understanding of its implications.

FAQs

Q1: What is a FINOP in simple terms?

Ans: A FINOP is a registered senior manager in charge of financial operations and compliance of a Broker-dealer registered with FINRA.

Q2: Why do firms need a FINOP?

Ans: Broker-dealers require a FINOP to ensure compliance with financial regulations, net capital standards, and maintain transparency within the company as required by FINRA.

Q3: Can a FINOP work for multiple firms?

Ans: Yes, especially if they are outsourced. However, FINRA must approve them for each role.

Q4: What happens if a firm doesn’t have a FINOP?

Ans: Operating without a designated FINOP is a violation of FINRA rules and may lead to regulatory actions, including fines and suspension.